Property Investment Chicago: A Comprehensive Guide to Profitable Opportunities

Chicago’s diverse real estate market offers investors a unique blend of stability and growth potential, making Property Investment Chicago an attractive option. With its strong rental demand, varied neighborhoods, and relatively affordable entry points compared to coastal cities, the Windy City continues to attract both seasoned and first-time real estate investors.

Top 10 Chicago Property Investment Opportunities Compared

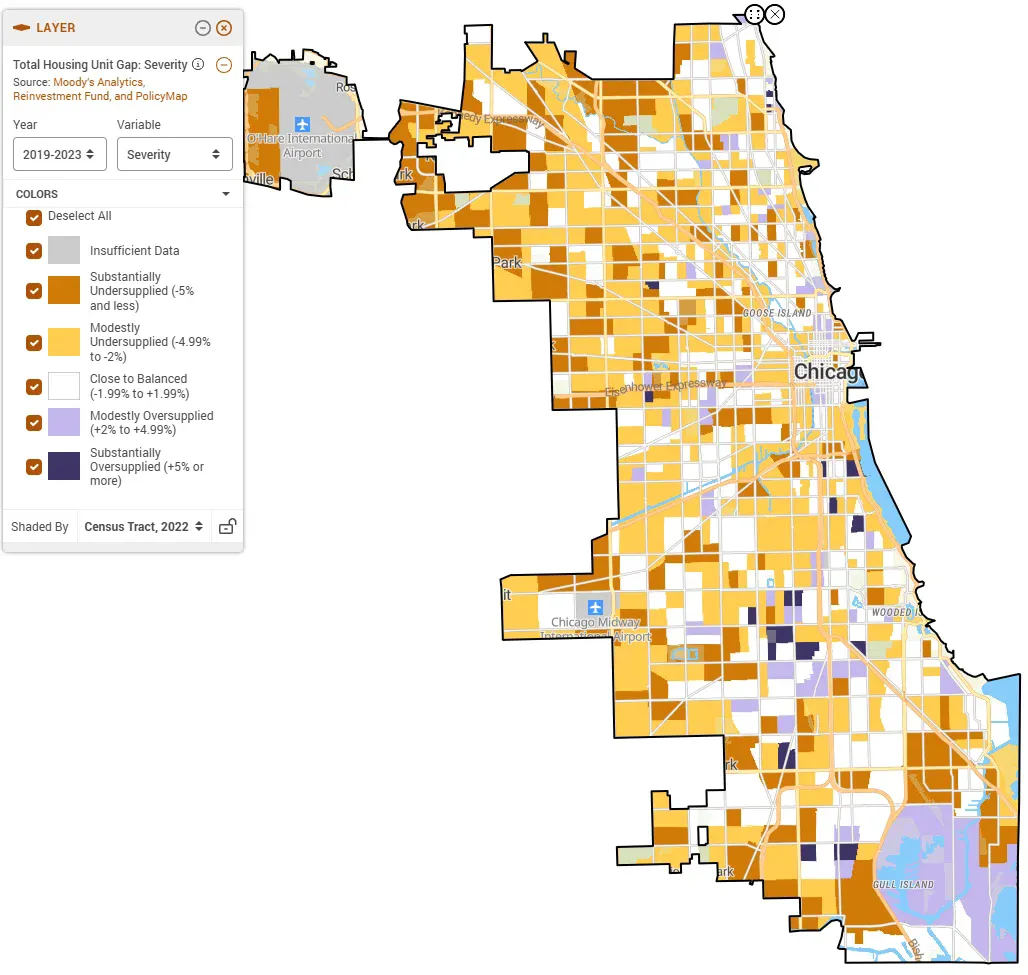

Chicago’s diverse neighborhoods offer varying investment potential depending on your strategy and goals. This comparison helps you identify which areas align with your investment criteria:

| Property Type | Target Neighborhood | Investment Strategy | Key Considerations |

| Multi-Family (2-4 units) | Rogers Park | Long-Term Rental | Proximity to Loyola University, Red Line access, stable tenant pool, 6-8% typical cap rate |

| Single-Family Home | Humboldt Park | Fix-and-Flip | Gentrifying area, The 606 trail proximity, emerging restaurant scene, 15-20% potential ROI |

| Condo | South Loop | Short-Term Rental | Near McCormick Place, museum campus, high tourism, 20-30% premium over long-term rentals |

| Multi-Unit Building (5+ units) | Uptown | Value-Add Rental | Improving area, Wilson Red Line renovation, lakefront access, 7-9% potential cap rate |

| Single-Family Home | Pilsen | Long-Term Rental | Strong arts community, Hispanic cultural hub, Pink Line access, 5-7% typical cap rate |

| Turnkey Multi-Family | Logan Square | Long-Term Rental | Trendy area, Blue Line access, strong rental demand, 5-6% typical cap rate |

| Mixed-Use Building | West Town | Commercial/Residential | Growing commercial corridor, residential upper floors, 6-8% potential cap rate |

| Condo | West Loop | Long-Term Rental | Restaurant row, Google/McDonald's offices, high-end rentals, 4-5% typical cap rate |

| Single-Family Home | Bronzeville | Fix-and-Hold | Historic district, revitalization, proximity to downtown, 8-10% potential cap rate |

| Turnkey Single-Family | Avondale | Long-Term Rental | Up-and-coming area, Blue Line access, family-friendly, 5-7% typical cap rate |

Find Your Ideal Chicago Investment Property

Looking for turnkey investment properties or value-add opportunities in these high-potential Chicago neighborhoods? Our team can help you identify and acquire properties that match your investment criteria.

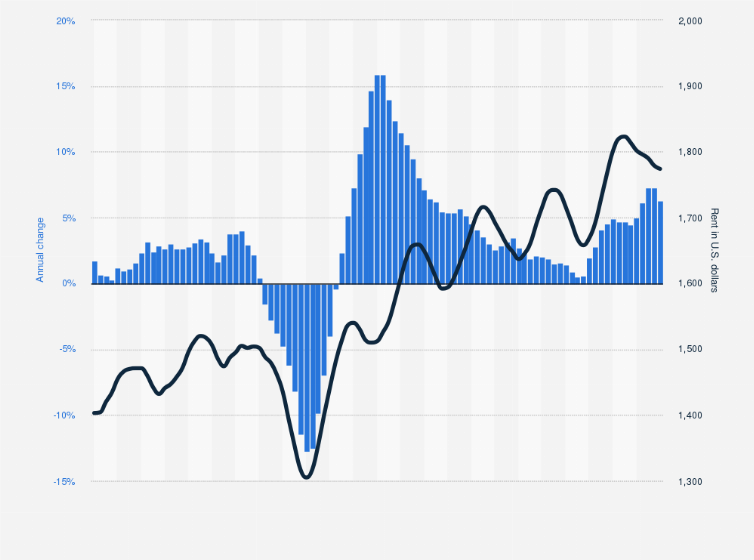

Chicago Real Estate Market Overview: Why Invest Now?

Chicago’s real estate market presents a compelling case for investors in 2026. While the city experienced some pandemic-related challenges, the market has shown remarkable resilience with steady appreciation in key neighborhoods. The median home price in Chicago sits at approximately $320,000, offering significantly better value than comparable major metropolitan areas.

Several economic factors make Chicago particularly attractive for property investment:

Diverse economy anchored by finance, technology, healthcare, and manufacturing sectors

Major corporate headquarters including Boeing, McDonald’s, and Walgreens

Strong rental demand from young professionals, students, and families

Extensive public transportation network enhancing property values near transit hubs

World-class universities creating consistent student housing demand

The Chicago rental market remains robust with average rents increasing 5.8% year-over-year. Vacancy rates hover around 5.2%, indicating healthy demand without oversaturation. These fundamentals create an environment where investors can find cash-flowing properties with potential for long-term appreciation.

Ready to Explore Chicago Investment Properties?

Get personalized recommendations based on your investment goals and budget. Our local experts will help you identify high-potential opportunities in Chicago’s diverse neighborhoods.

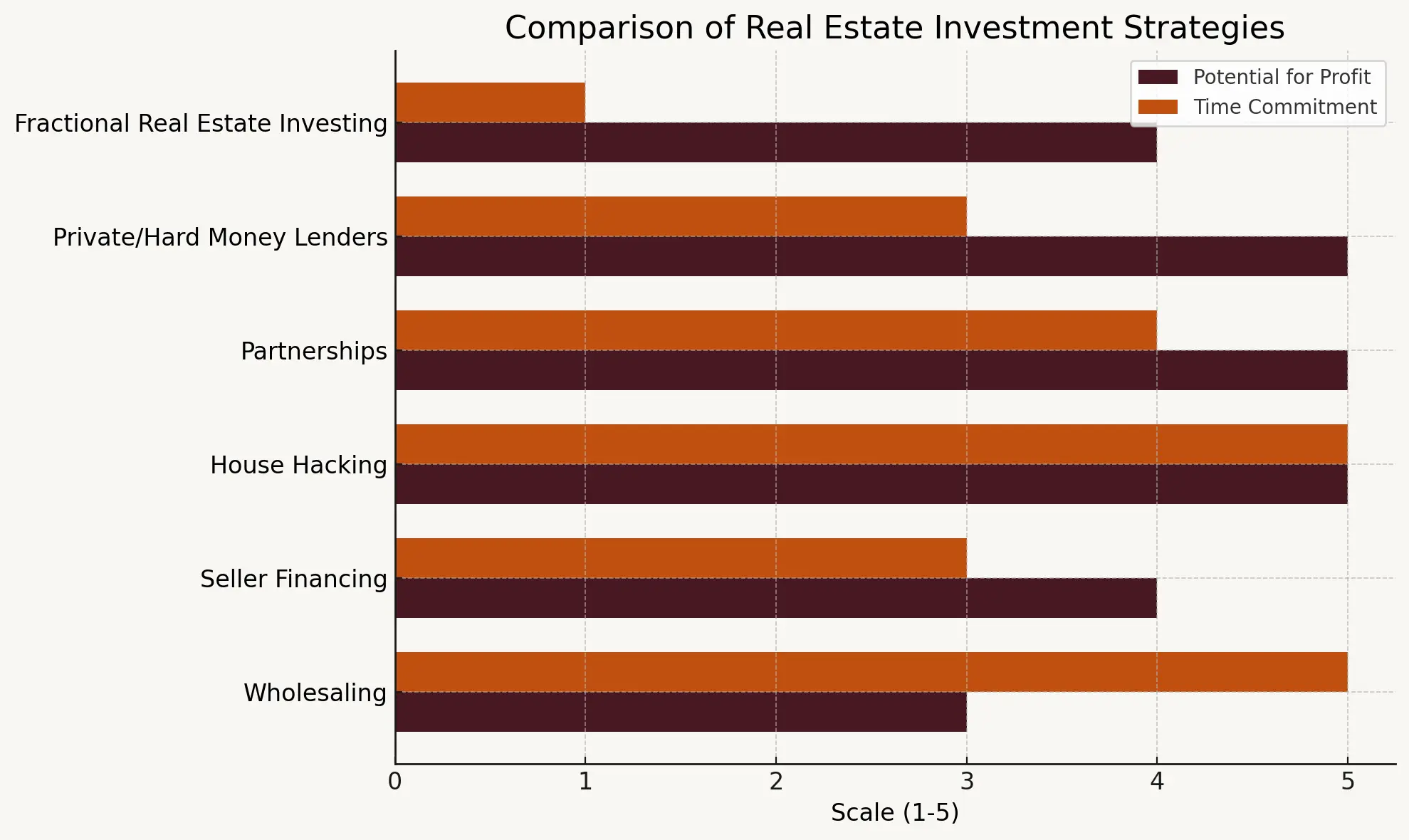

Effective Property Investment Chicago Strategies

Success in Chicago’s real estate market depends on selecting the right investment strategy for your goals, timeline, and risk tolerance. Here are the most effective approaches for Chicago property investors:

Long-Term Buy and Hold

Chicago’s stable rental market makes it ideal for buy-and-hold investors seeking consistent income and gradual appreciation. This strategy works particularly well in established neighborhoods with strong rental demand like Lincoln Park, Lakeview, and Hyde Park. Investors typically aim for properties that generate positive cash flow after accounting for mortgage, taxes, insurance, and maintenance costs.

Fix and Flip

Chicago’s varied housing stock offers abundant opportunities for value-add investors. Neighborhoods experiencing revitalization like Humboldt Park, Pilsen, and Woodlawn present opportunities to purchase undervalued properties, renovate them, and sell at a profit. This strategy requires local market knowledge, reliable contractors, and accurate renovation cost estimates.

Multi-Family Investments

Chicago’s famous two-flat and three-flat buildings provide an accessible entry point for small-scale multi-family investing. These properties allow investors to live in one unit while renting others, effectively subsidizing their housing costs. Popular areas for multi-family investments include Albany Park, Avondale, and Rogers Park.

Short-Term Rentals

With Chicago’s robust tourism and business travel sectors, short-term rentals can generate premium returns in the right locations. Properties near downtown, convention centers, and tourist attractions perform best, though investors must navigate Chicago’s evolving regulations around vacation rentals.

Key Considerations for Chicago Property Investors

Property Taxes and Assessment Cycles

Chicago property taxes deserve special attention from investors. Cook County uses a triennial assessment system, meaning properties are reassessed every three years. This can lead to significant increases in property tax bills, which must be factored into your investment calculations. Currently, Chicago’s effective property tax rate averages around 2.10%, higher than many other major cities.

Chicago Landlord-Tenant Ordinance

Chicago’s Residential Landlord and Tenant Ordinance (RLTO) provides substantial protections for tenants. Landlords must be familiar with specific requirements regarding security deposits, maintenance responsibilities, and eviction procedures. Non-compliance can result in significant penalties, including damages equal to two times the security deposit plus attorney’s fees.

Neighborhood-Specific Regulations

Some Chicago neighborhoods have additional regulations that impact investors. For example, certain areas have restrictions on short-term rentals, while others have special service area (SSA) taxes that fund local improvements but increase your carrying costs. Research neighborhood-specific ordinances before investing.

Property Management Considerations

Chicago’s extreme seasonal weather presents unique property management challenges. Building systems must withstand freezing winters and hot, humid summers. Budget for seasonal maintenance like snow removal and regular inspection of heating systems. Many out-of-state investors partner with local property management companies to handle these location-specific issues.

Financing Options for Chicago Investments

Chicago investors have access to conventional financing, FHA loans (for owner-occupied multi-units), VA loans for veterans, and various portfolio loan options. Local banks often offer competitive rates for investment properties in neighborhoods they’re familiar with. For larger multi-unit properties, commercial loans typically require 25-30% down with rates slightly higher than residential mortgages.

Spotlight: Emerging Chicago Investment Neighborhoods

While established areas like Lincoln Park and Lakeview have long been investor favorites, savvy property investors are increasingly looking to these emerging neighborhoods for better returns:

Humboldt Park

Once overlooked, Humboldt Park has seen significant appreciation driven by The 606 elevated trail and spillover from nearby Logan Square. Investors find value in classic Chicago graystones and brick two-flats, many of which still need renovation. The neighborhood’s vibrant Puerto Rican culture, expansive park, and emerging restaurant scene attract young professionals seeking affordability.

Bronzeville

This historic South Side neighborhood is experiencing a renaissance. Once the center of African American culture in Chicago, Bronzeville offers stunning historic homes at accessible price points. Its proximity to downtown, the lakefront, and the ongoing Michael Reese Hospital redevelopment make it a strong contender for long-term appreciation. Investors focus on restoring vintage properties while maintaining the area’s rich character.

Avondale

Often described as “the next Logan Square,” Avondale offers similar housing stock and Blue Line access at more accessible price points. The neighborhood’s mix of Polish and Latino influences creates a unique cultural landscape. Investors target brick bungalows and multi-unit buildings, many of which can still be found at prices that support positive cash flow. The growing restaurant and brewery scene signals continued upward momentum.

Chicago Turnkey Investment Properties: The Hands-Off Approach

For investors seeking minimal involvement, particularly those living outside Chicago, turnkey investment properties offer an attractive option. These fully renovated, tenant-occupied properties allow for immediate cash flow without the hassle of renovations or lease-up periods.

Benefits of Chicago Turnkey Investments

Immediate rental income from day one of ownership

Professional renovation completed to modern standards

Established tenant relationships and rental history

Often includes property management services

Simplified due diligence with proven performance metrics

Popular Chicago Neighborhoods for Turnkey Investments

While turnkey properties can be found throughout Chicago, they’re most common in stable, middle-class neighborhoods with strong rental demand and moderate price points. Areas like Rogers Park, Albany Park, Portage Park, and South Shore frequently offer turnkey opportunities with cap rates ranging from 5-8%.

When evaluating turnkey investments, thoroughly verify all property financials, inspect the quality of renovations, and research the property management company’s track record. The premium paid for turnkey properties should be justified by quality work and established rental performance.

Discover Chicago Turnkey Investment Properties

Looking for hands-off investment opportunities in Chicago? Our curated selection of turnkey properties offers immediate cash flow potential with professional management already in place.

Is Chicago Property Investment Right for You?

Chicago’s real estate market offers diverse opportunities for investors at various experience levels and with different financial capacities. The city’s combination of relatively affordable entry points, strong rental demand, and potential for appreciation creates an attractive investment landscape.

Success in Chicago property investment hinges on neighborhood selection, property condition assessment, understanding local regulations, and implementing the right management strategy. Whether you’re drawn to turnkey properties in established areas or value-add opportunities in emerging neighborhoods, Chicago’s varied housing stock can accommodate your investment approach.

For out-of-state investors, partnering with local experts—from real estate agents specializing in investment properties to property managers familiar with Chicago’s unique challenges—is essential for long-term success. The right team can help you navigate everything from property acquisition to tenant relations and maintenance issues.

As with any real estate investment, thorough due diligence is critical. Research neighborhood trends, understand the impact of property taxes on your returns, and develop realistic projections that account for all expenses. With careful planning and local expertise, property investment Chicago can deliver both steady cash flow and long-term wealth building.

Ready to Start Your Property Investment Chicago Journey?

Our team of Chicago investment specialists can help you identify opportunities that align with your financial goals, risk tolerance, and preferred level of involvement.